This information is current as at 1 July 2022.

If none of the above apply the ATO will consider factors like when an employee joined a fund and other relevant information to identify the 'stapled' fund.Įmployees will also be able to see details of their 'stapled' super fund in their myGov account. do not apply it will be the fund that held the largest balance at the end of the previous financial year.

doesn’t apply to the eligible funds it will be the fund that received the most recent contribution over the selected period. The most recent fund identified by the ATO will be the employee’s 'stapled' fund for the selected period (from the start of the previous financial year until the day when the ATO applies tiebreaker requirements).

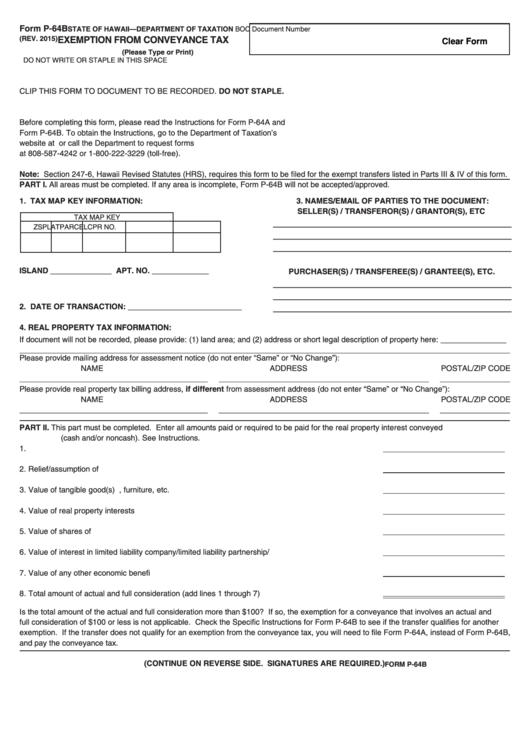

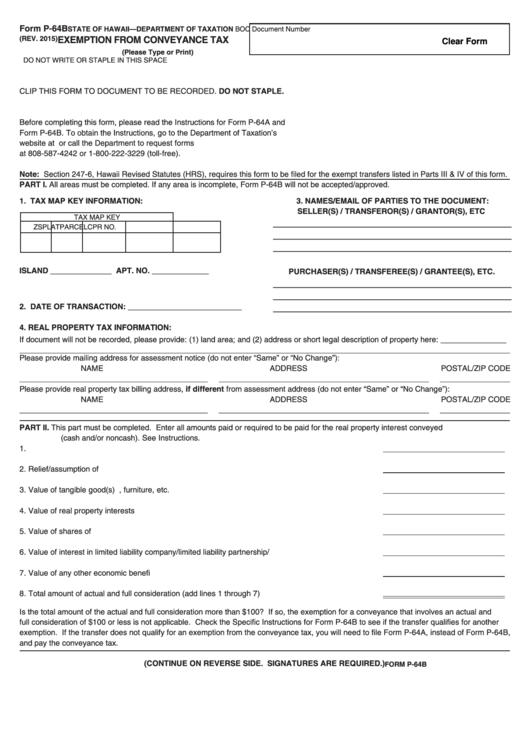

Where the ATO identifies multiple funds that may be 'stapled' to an employee, four-step tiebreaker rules apply according to the following order. The ATO also provides more information on requesting ‘stapled’ super fund details for employees including a ‘stapling’ webcast for employers. Diagram: 'Stapling' – a guide for employers, from 1 November 2021 * Super Guarantee contributions can also be made to a fund specified under a workplace determination or an enterprise agreement if the determination was made before 1 January 2021.Įmployers will be able to identify a new employee’s 'stapled' fund by logging onto ATO online services and entering the employee’s details. You can use the process chart below to help you understand what needs to happen under the new rules. For more information on SG penalties, visit the ATO website. If an employer doesn’t pay SG into a new employee’s ‘stapled’ fund from 1 November 2021, they may be in breach of choice of fund law and incur associated penalties.

If the new employee doesn’t have an existing 'stapled' fund and doesn’t choose a fund, then you can create a new account with your nominated default super fund*. If they do, you must make payments to this account. Where a new employee does not choose a super fund, you must contact the ATO to see if the employee has an existing super fund – their ‘stapled’ fund. Where a new employee doesn’t make their choice of super fund: If a new employee notifies you of their preferred fund (using the Standard Choice Form), you must make payments into this account. Where a new employee makes their choice of super fund: The process of making Super Guarantee (SG) contributions for any new employees has changed and this impacts your employee onboarding and payroll processes. You can read more about 'stapling' in our Q&As at the end of this article. You can identify a new employee’s ‘stapled’ fund by logging onto ATO Online Services and entering the employee’s details. You will need to check with the Australian Taxation Office (ATO) if your employee has a 'stapled' fund. There are tie-breaker rules to determine which fund will be ‘stapled’ to an employee where they have multiple funds. ‘Stapling’ is where your new employees will automatically keep their existing super fund (if they have one) when they start their employment with you, unless they choose a fund themselves. 'Stapling' came into effect on 1 November 2021. We can help you understand the impact they have on how you manage your superannuation obligations and make sure you stay compliant. Over the past year, there have been some significant changes to superannuation that affect employers.

0 kommentar(er)

0 kommentar(er)